When facing overwhelming debt, filing for bankruptcy can be a viable solution to help you regain control of your finances. By filing for bankruptcy, you can reduce financial stress and chart a new course toward a more secure financial future. To fully grasp the impact of filing for bankruptcy, it’s essential to understand which types of debts can be discharged and which cannot. Furthermore, gaining a thorough understanding of the specific rules and regulations governing bankruptcy will be crucial for successfully navigating the bankruptcy process.

What Does it Mean to Discharge Debt?

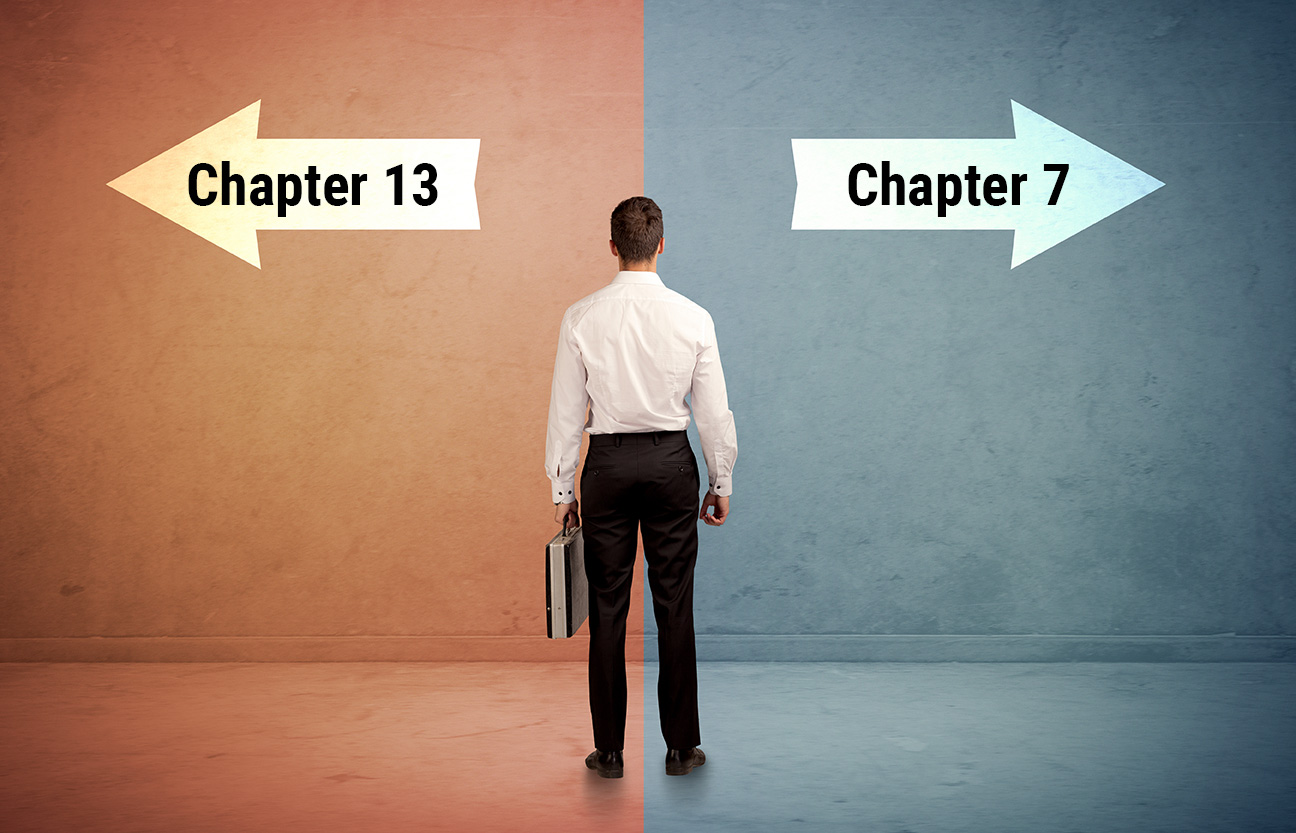

When a debt is discharged in Chapter 7 and Chapter 13 bankruptcy, it means that the debtor is no longer legally responsible for paying that debt. Being free of certain debts can give individuals the peace of mind they need to start making new strides forward toward financial stability.

It is important to note that in Chapter 13 bankruptcy cases, debts are not discharged until the set amount specified in your repayment plan is completely paid back.

Debts Eligible for Discharge

Discharging debt by filing for bankruptcy is a powerful tool to help set oneself on the path to a peaceful financial future. To fully understand the scope of how powerful it can be, here are the debts that can commonly be discharged through bankruptcy:

- Credit card debt

- Medical bills

- Personal loans

- Utility bills

- Repossession deficiency balances

- Past-due rent

Although all of these debt types have the ability to be discharged, it is critical to consult a bankruptcy attorney to ensure that your filing is done correctly. Debt discharges are subject to challenge by creditors, and the courts can deny discharges if they find any intentional wrongdoing.

Debts Ineligible for Discharge

While bankruptcy is a powerful tool for managing debt, it is critical to note that not every debt type is dischargeable. Here are the types of debts that cannot be discharged through the bankruptcy process:

- Student loans

- Child support and alimony

- Certain types of tax debts (e.g., recent tax debts, tax liens)

- Debts incurred through fraud or malicious activities

- Fines and penalties owed to government agencies

- Personal injury debts caused by driving under the influence

- Condo or cooperative housing fee debts

- Debts that are not listed in your petition

Despite the inability to discharge these debts, that does not mean filing for bankruptcy may not still be a viable option for you. Consulting a bankruptcy professional can help you determine if bankruptcy is the right solution for you.

The Best Way to Navigate Bankruptcy

Navigating the bankruptcy process can be daunting; there are so many legal intricacies that leave people feeling lost and unsure. From which debts are able to be discharged to the steps that need to be taken before filing, there are many factors to consider before you even file the paperwork.

If you feel overwhelmed by the debt you are carrying and are considering filing for bankruptcy, contact Adam M. Freiman, a Maryland bankruptcy lawyer! He can help guide you through the process and provide the expertise needed to help you achieve a fresh financial start.