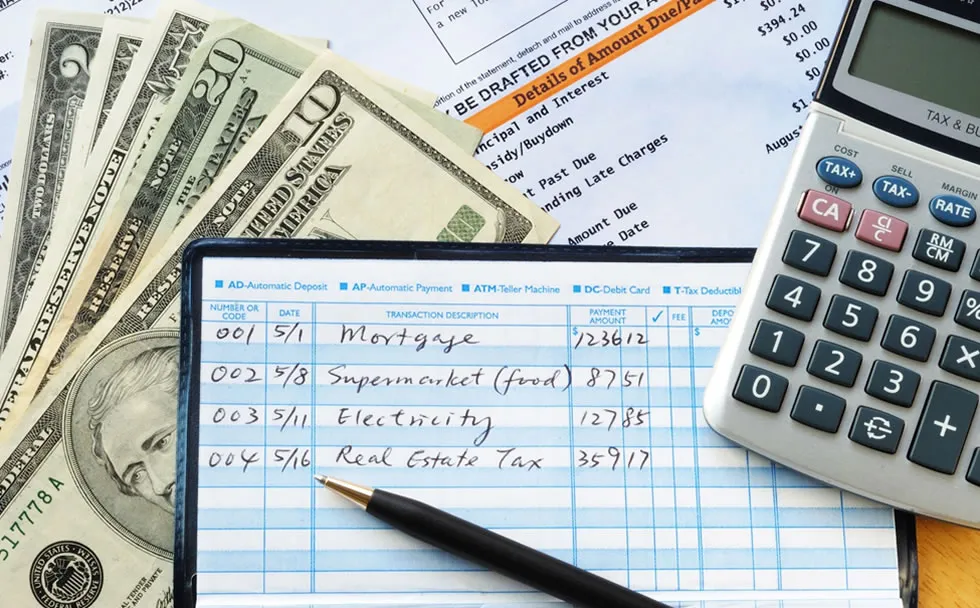

Filing for bankruptcy? Find out what happens to your bank account and the money in it.

When people have extreme financial issues and cannot repay debts, they may consider bankruptcy. However, bankruptcy is not an easy decision. There are a lot of rules involved, and you may have questions. For example, what happens to your bank accounts?

For the most part, if you file for Chapter 7 bankruptcy, you should be able to keep your bank account along with the money inside it. This will depend on your debts and exemptions. For example, if you owe money to the bank, then the bank can deduct that money from your account.

Exemptions

As far as exemptions go, these vary from state to state. For example, in Maryland, you can hold onto $6,000 in cash and $5,000 of real or personal property as part of a wildcard exemption. If you declare the funds as exempt, the bankruptcy trustee cannot take them and give them to creditors.

Money That is Protected

You can also claim exemption based on the source of the money. In Maryland, you can claim earned but unpaid wages, either 75% or $415 per week, whichever is greater. Unemployment compensation, workers’ compensation benefits, crime victims’ compensation, and general assistance are all also protected under state law. So are disability and health benefits, life insurance proceeds, and certain pensions.

Failure to Disclose

You will need to include any checking accounts you have in your initial filing for a Chapter 7 bankruptcy. If you have less than that amount in a bank account, you cannot simply ignore it or fail to disclose it. Failure to disclose a bank account can result in severe consequences. If the bankruptcy trustee or judge finds out that you intentionally did not disclose it, you could lose all the money and even face a criminal charge.

Non-Exempt Funds

It is also possible that the money in a checking account is not exempt. If it is not, you will need to turn it over to the bankruptcy trustee so that it can be used to repay creditors. Sometimes only part of the money in a checking account is exempt, and the rest may not be exempt.

If you have money that is not exempt, the bank may freeze your account. A freeze holds the assets in your account. You will not be able to use the money. If you do in fact have exempt assets, you should let the bankruptcy trustee know so that they can get the bank to release the freeze. In case this happens, you should ensure that any checks that you write from a checking account have cleared before filing for bankruptcy.

Have more questions about assets and bankruptcy?

At The Law Offices of Adam M. Freiman, we have answers. We’ll help you take the first step towards regaining your financial freedom. To schedule a consultation, fill out the online form or call (410) 486-3500.