Interested in bankruptcy? You are not alone. In the United States alone, more than 400,000 people file for bankruptcy every year.

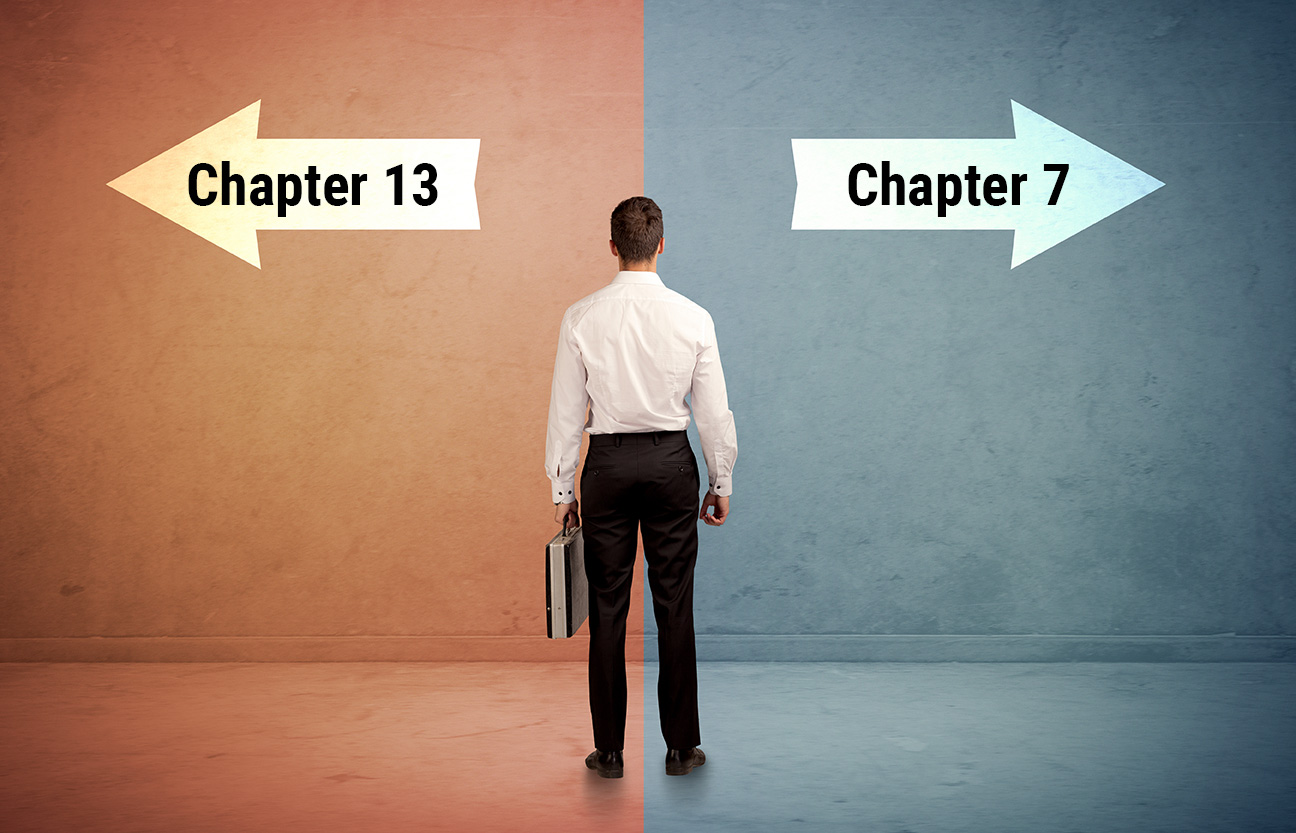

Bankruptcy can be done quickly, especially Chapter 7. This type of bankruptcy wipes out debt in just a matter of months, allowing you to get a fresh start.

While bankruptcy may seem like a quick process, it is not exactly easy. It is best to get a lawyer on your side to guide you through the process. Plus, you need to be prepared for bankruptcy, which means getting your documents and debt in order. Here is what you need to do.

Evaluate Your Finances

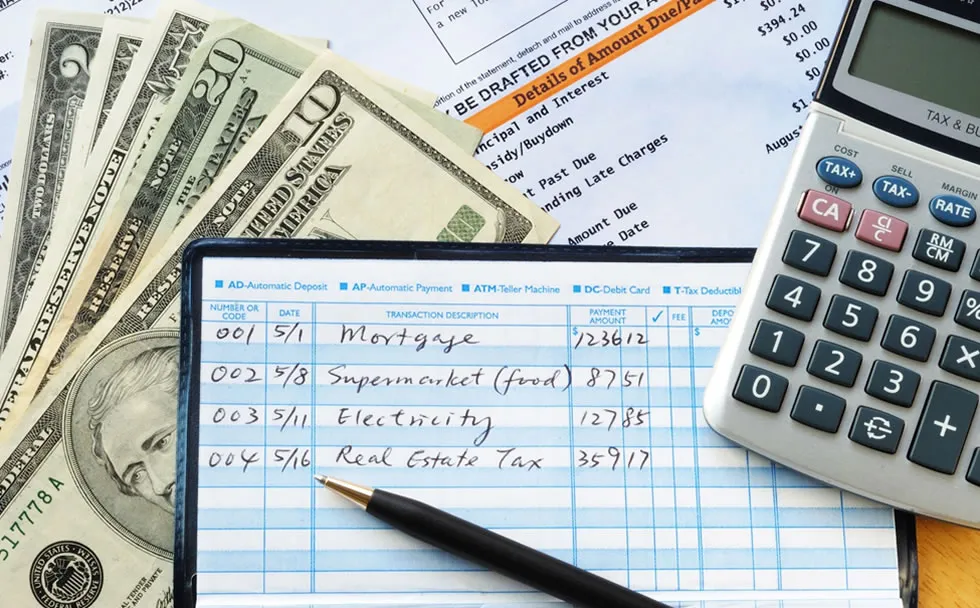

Before filing for bankruptcy, you will want to get a look at your financial situation. This includes:

- Listing all debts. Include credit cards, loans, medical bills, and any other debts. Gather all documentation relating to your debts. Make a list of your creditors and the amount you owe them. You should also gather tax returns for the past four years.

- Assess income and expenses. Create a detailed list of your monthly income and expenses. Gather documentation from pay stubs, W-2s, self-employed earnings, income from assets, and any income from government benefits. Your bank and credit card statements can be helpful for determining expenses.

- Identify assets. Make a comprehensive list of all your assets, including property, vehicles, bank accounts, and personal belongings. You may also need loan balances, proof of insurance, monthly payment amounts, and other documentation. Have titles, deeds, and any other documents that prove ownership of assets.

Understand Your Debt

By gathering all your financial paperwork and reviewing your credit report, you will get an idea of the types of accounts you have open and how much debt you have. This will help you determine if bankruptcy is the best course of action. For example, child support, alimony, and tax debts cannot be discharged. If you have other debts, they may be discharged in Chapter 7 bankruptcy. You can also pay them down in Chapter 13 bankruptcy through a repayment plan. You would have to qualify for Chapter 7 bankruptcy through a means test that assesses your income.

Attend Credit Counseling

Before you submit your bankruptcy forms, you are required to attend and complete a mandatory course from an approved credit counseling agency. You must do this regardless of the type of bankruptcy you pursue.

The good news is that you can complete the course online. You must do so within 180 days of filing for bankruptcy. File the certificate of completion with your bankruptcy petition.

Contact Us Today

The bankruptcy process is often quick, lasting just several months. However, you need to be prepared for it. Get all your documentation in order first. Next, meet with a bankruptcy lawyer from The Law Offices of Adam M. Freiman. We will guide you through the next steps so you can get the fresh start you truly need. Get started by scheduling a consultation. Call (410) 486-3500 or fill out the online form.