Bankruptcy can be a complicated and stressful process; between making the hard choice to file and feeling the societal stigma of going through financial hardships, it is daunting. The daunting feeling of going through bankruptcy can increase when you feel like you can’t understand the vernacular involved in filing. Understanding the key bankruptcy terms and their definitions can help make the process less overwhelming and enable you to make more informed decisions. Here are some common bankruptcy terms and their explanations:

Bankruptcy

First and foremost, let’s cover the definition of the word that defines the process. Bankruptcy is a common legal process that provides individuals or businesses with relief from their debts, either by restructuring their finances or liquidating assets to repay creditors.

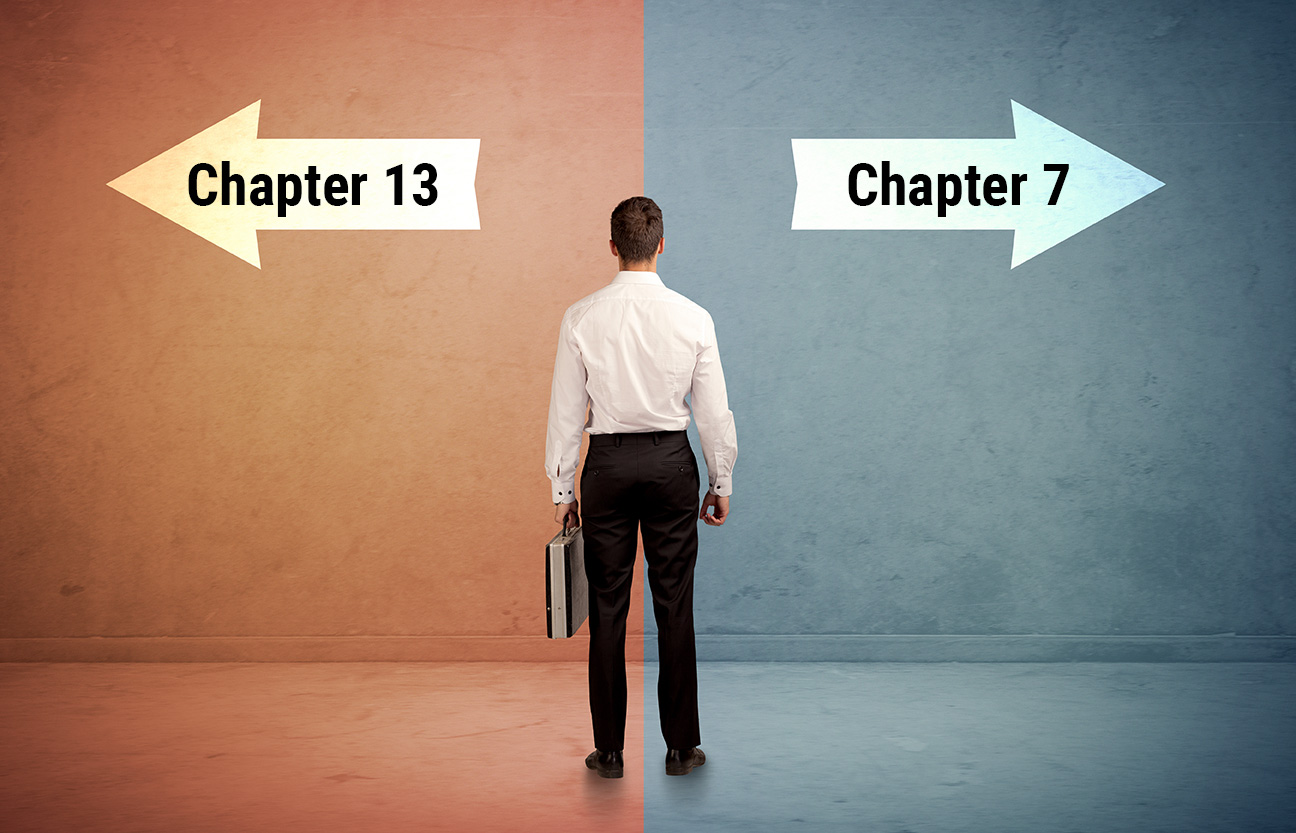

Chapter 7 Bankruptcy

You are going to see this next one quite often because it is the most common type filed by individuals. Chapter 7 bankruptcy, also referred to as liquidation bankruptcy, involves selling the debtor’s nonexempt property and the distribution of the proceeds to creditors. Many forms of debt can be discharged in Chapter 7 bankruptcy, providing the debtor with a fresh financial start.

Chapter 13 Bankruptcy

This next one may be less often filed; however, it’s important to know what it means. Commonly known as “reorganization” bankruptcy, Chapter 13 entails creating a detailed repayment plan that allows debtors to pay back their debts over a set period of three to five years. This type of bankruptcy is often suitable for individuals with a regular income who want to keep their assets.

Trustee

Everyone involved in this process has a title. In bankruptcy cases, a trustee is appointed to oversee the process and ensure that creditors are treated fairly. The trustee’s responsibilities may include reviewing the debtor’s financial affairs, liquidating assets in Chapter 7 cases, or administering the repayment plan in Chapter 13 cases.

Debtor

If you are considering filing, you will be the debtor. Being the debtor means you are the individual or entity that owes money and is seeking relief through the bankruptcy process.

Creditor

Now, let’s turn our attention to who the money and debts are owed to. A creditor is a person or organization to whom the debtor owes money. This can include banks, credit card companies, and other lenders.

Discharge

One of the best words to hear in bankruptcy is discharge. A discharge is an order from the court that releases the debtor from personal liability for qualified debts. That means they are no longer legally required to repay those debts. Once a debt has been discharged, creditors are prohibited from taking any form of collection action on that debt.

Exempt Property

There is often a fear associated with bankruptcy that you will lose everything; the term exempt property proves that wrong. Certain types of property are designated as exempt, meaning they are protected from being used to repay creditors in a bankruptcy case. Exempt property typically includes necessities such as clothing, household goods, and a primary residence.

Automatic Stay

An automatic stay is a term that will bring some immediate relief if you are considering filing. When a bankruptcy case is filed, an automatic stay immediately goes into effect. This puts a halt to most collection actions by creditors. Ultimately, this action provides the debtor with relief from creditor harassment and gives them the opportunity to work out a plan to resolve their financial difficulties.

Understanding these common bankruptcy terms is essential for anyone navigating the bankruptcy process. If you are considering filing for bankruptcy, it’s crucial to partner with a qualified bankruptcy lawyer to help ensure you fully understand the implications of each term and how they apply to your specific situation.

Adam M. Freiman – Baltimore Bankruptcy Lawyer

If you are considering filing for bankruptcy, you don’t have to go through the process alone. Adam Freiman is here to help you navigate bankruptcy with ease.

Adam has over 25 years of law experience working on every case type, from bankruptcy to criminal cases. He was also one of the founders of one of Baltimore’s most touted bankruptcy law firms. However, through his years of experience, Adam learned that bigger doesn’t mean better. Instead of making clients jump through hoops, talking to various paralegals, and mudding the communication waters, he likes to take a one-on-one approach.

If you choose Adam M. Freiman as your bankruptcy lawyer, you can trust that he will represent you personally. Contact us today to learn more about how Adam can help you with your bankruptcy case!